RenoFi Loans use the After Renovation Value instead of the home's current value, enabling the most borrowing power at the lowest rates available through our partner network. Thanks to RenoFi, homeowners now have a smart way to finance their renovation and tackle everything on their wishlist.

Home Equity Renovation LoansRenovation Home Equity Loans are second loans separate from your mortgage and allow you to borrow against the current or future equity of your home.

RenoFi HELOCFlexibility of drawing what you need when you need it without the need to refinance your first mortgage.

Loan amounts of $25k to $500k Borrow up to 90% of the AFTER renovation value Keep your existing mortgage Variable rate Multiple draw and repayment periods available Line of credit, full amount available to draw at closing RenoFi HELOCFlexibility of drawing what you need when you need it without the need to refinance your first mortgage.

Loan amounts of $25k to $500k Borrow up to 90% of the AFTER renovation value Keep your existing mortgage Variable rate Multiple draw and repayment periods available Line of credit, full amount available to draw at closing RenoFi Fixed Rate

Unlike traditional loans, RenoFi Loans factor in what your home will be worth after the renovation.

Multiple payment terms available. Rates are based on the after renovation value.

Have a great rate locked in on your first mortgage? Keep it!

No draws, no inspections, no contractor involvement with loan funds.

Justin & Nicki's renovation added 850 sq. ft. to their home in a new great room with entry from backyard. The renovation also included a new master suite with walk-in closets and all new exterior siding & roof.

Post-Renovation Home Value

$807,000Pre-Renovation Home Value

$405,000 $200,000DJ & Vanessa's recent renovation transformed unused attic space into a new master suite. Outdoors they added a fire pit & a revamped back patio for fun summer nights with their three young children.

Post-Renovation Home Value

$900,000Pre-Renovation Home Value

$780,000 $256,000From gutted to grand an eleventh-hour RenoFi loan not only helped this family upgrade as they downsized but also enabled them to transform their once-modest welling into a stunning, thoughtfully designed abode.

Post-Renovation Home Value

$505,000Pre-Renovation Home Value

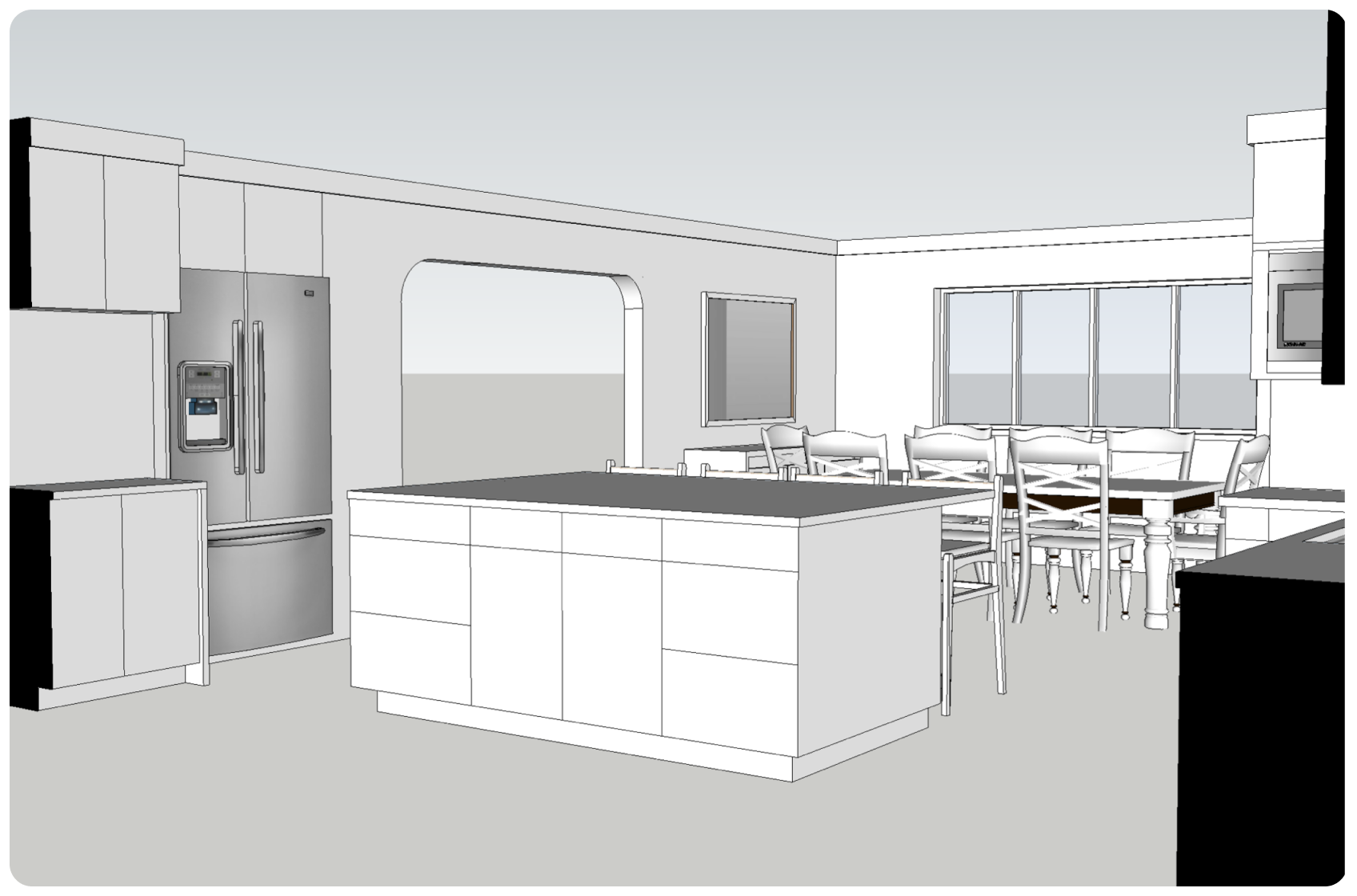

$385,000 $230,000When Ken & Katie's family of two became four, they began casually looking for the upgrade. Now their home has a true Master Suite and large, eat-in kitchen while still staying in the area they grew to love.

Post-Renovation Home Value

$550,000Pre-Renovation Home Value

$385,000 $185,000A “RenoFi Loan” refers to loans made by third party lenders powered by RenoFi’s proprietary Renovation Underwriting technology. RenoFi Loans use the home’s After Renovation Value (“ARV”) to increase homeowners’ borrowing power. RenoFi is not a lender but instead, works with various lenders to incorporate its renovation underwriting technology into lenders’ existing loan-underwriting process. RenoFi works with homeowners to find lenders offering both RenoFi Loans and other traditional loan products, including mortgage loans and personal loans.

A cash-out refinance loan, home equity loan, or home equity line of credit (HELOC) allows you to borrow against the current value of your home, whereas RenoFi Loans allow you to borrow against the after renovation value, or future value of your home. For homeowners who have been in their homes for 10+ years, borrowing against current home equity is fine because they’ve built up a lot of equity over the years and don’t have as large of an outstanding mortgage balance. But for recent homebuyers, a true renovation loan often offers higher borrowing power. It is important to note that if you take a RenoFi Loan there is no guarantee your home will increase in value and, in rare cases, you may owe more than your home is worth.

RenoFi’s services are free for homeowners, whether you decide to move forward or not. You can't obtain a RenoFi Loan without working with RenoFi first. We partner with specific credit unions to offer the RenoFi Loan, but our RenoFi team will do everything to prepare you to apply before handing you off to the credit union. You can look at us as a concierge, who will walk you through the journey of considering and then preparing for a renovation. Banks love us because they prefer to work with educated consumers. After our process, you’ll be ready to rock and roll with your lender. Our RenoFi advisors are seasoned experts that will guide you through finding the best financing option for your renovation project, regardless of whether or not you decide to apply for a RenoFi Loan with one of our lending partners.

Yes, most lenders offering RenoFi Loans allow you to apply once you’ve closed on the home, meaning they don’t have any “seasoning” requirements. The RenoFi Home Equity Loan is specifically designed for homeowners who’ve recently purchased or are about to purchase a home, and are therefore “equity light,” and aren’t able to borrow enough money to fund a renovation with a traditional home equity loan.

Lenders base this on several different metrics including your current home value, your home’s estimated “after renovation value,” your outstanding mortgage, and your overall financial health. Most lenders allow RenoFi Loans to cover up to $500k in renovation costs, though please note that loans over $250k will have stricter qualification criteria. Additionally, most lenders allow homeowners to borrow up to 125% of the current home value and up to 90% of the after renovation value. Some lenders will even go up to 150% of the current home value. See how RenoFi’s home improvement loan calculator helps you determine how much you can borrow.

After renovation value is the estimated value of your home after your renovation is complete. You can estimate your after renovation value by using the current value of your home, plus the added value of your planned renovations. Homeowners can borrow up to 90% of their home’s after renovation value through a RenoFi Loan. You can find out your home’s after renovation value by getting an “as completed” appraisal on your home. This appraisal is based on the proposed renovation plan, on the condition that it is completed. Read more about how the after renovation value is determined here.

No! There are several different versions of RenoFi Loans, including home equity options that do not require you to refinance. With so many homeowners having locked in ultra low rates, this is especially helpful and one of the key things that makes RenoFi Loans so unique!

Rates are set by the lenders and can vary slightly lender to lender. RenoFi Renovation Home Equity Loan rates vary depending on several different factors but the two most critical are your credit score and the loan to value ratio (LTV) based on your after renovation value. In general, RenoFi Loan rates are often better than the home equity loan rates you’d find at most banks. That’s possible because RenoFi Loans are offered by credit unions who are well known for having low rates & fees. To learn more about rates, try the RenoFi Loan calculator today.

Lenders offering RenoFi Loans may charge closing costs and fees as they would for any home equity loan. Closing costs vary by lender and for RenoFi Home Equity Loans range from several hundred dollars ($700-$800) up to 1% of the loan amount. These costs typically include an origination fee, title and escrow fees, tax certifications, recording fees, other underwriting costs paid by the consumer to the lender, and may include title insurance for higher loan amounts. Closing costs do not include the cost of the appraisal. The average appraisal cost is around $700, but can be in excess of $1000 depending on renovation size, complexity, and geographic location. It is important to note that the lender is taking the application and making a loan decision and that it is possible that you pay for an appraisal and are not approved for a loan.

During the renovation, some lenders may charge a monthly fee or a higher rate, but this is temporary and will cease once the renovation completes and RenoFi issues a certificate of completion.

The RenoFi fixed-rate home equity loan being offered by some of our lending partners has term options of 10, 15 and 20 years. The RenoFi variable-rate home equity line of credit structure varies by lender. You can learn more here on the RenoFi Loans page. Please note lender programs vary by lender and lenders vary by state. Speak with a RenoFi Advisor today to learn more.

There’s lots of documentable information related to your home, your income and your general financial situation that you need to have ready before you apply with a lender. If you’re interested in applying for a RenoFi Loan, we recommend reading this checklist, as well as the Top 14 Reasons Homeowners Can’t Qualify for a RenoFi Loan article.

RenoFi currently works exclusively with credit unions that provide RenoFi Loans. RenoFi will identify the best credit union for your situation, which usually means the one who can offer the best rates, lowest fees and the right loan amount.

Yes. RenoFi Loans act as a second mortgage, which means they won’t touch your first mortgage. No need to refinance your first mortgage if you’ve already locked in low interest rates!

Once you collect all of the documents necessary to apply for a RenoFi Loan and connect with a lender, RenoFi completes its Renovation Underwriting process, including the ordering of the appraisal. Appraisals are typically what takes the longest, typically between 14 & 30 days.. Once the appraisal is returned and the renovation underwrite is complete, you will apply with the lender and the lender will complete their financial underwriting, which can require an additional 15-30 days until close. Timing will depend on your unique situation and the lender that you’re matched with but you should expect approximately 30-60 days between both steps to close once the necessary documents are collected. RenoFi cannot guarantee that you will be approved for a loan with any lender offering RenoFi Loans, or in any specific time frame.

Most lenders offering RenoFi Loans today do not have any prepayment penalties built into their loans.

Nope! We’ve designed RenoFi Loans in a way that makes life much easier for homeowners & their general contractors. The entire loan amount is made available by the lender upfront. After the renovation is completed, the appraiser visits the home to issue a certificate of completion. Read more about the differences between RenoFi Loans vs other loan types.

After renovation value is the estimated value of your home after your renovation is complete. You can estimate your after renovation value by using the current value of your home, plus the added value of your planned renovations. Homeowners can borrow up to 90% of their home’s after renovation value through a RenoFi Loan. You can find out your home’s after renovation value by getting an “as completed” appraisal on your home. This appraisal is based on the proposed renovation plan, on the condition that it is completed. Read more about how the after renovation value is determined here.

You do not need a signed renovation contract to begin RenoFi’s Renovation Underwriting process, however you will need these documents to close with the partner lender. Lenders require finalized construction plans, along with a signed renovation contract between you and your contractor, and a detailed material and labor line item cost breakdown with a clear payment schedule. It’s important to get all of your ducks in a row before you make these commitments. Read this article to find out more about exactly what you need from your contractor in advance.

In order to be approved by a lender for a RenoFi Loan you will need to have finalized your renovation plans. Some homeowners wait to sign the actual contract between themselves and their General Contractor until they are officially approved for the financing and that is ok, but you will need a signed contract to close on the financing.

Load more faqs

Embarking on a home renovation project is an exciting milestone. RenoFi's resources will help you get started and make the right decisions along the way.

Understand how home appraisals impact your renovation project funding. Learn how renovations can increase your home's value and maximize your return on investment post-renovation.

Looking to put an addition on your home? Learn about the types of home addition loans, their pros and cons, and how to use them to finance your project.

Explore ADU housing and the 2023 challenges for accessory dwelling units. Gain insights into trends, regulations, and considerations. Find affordable ways to fund your ADU renovation project.